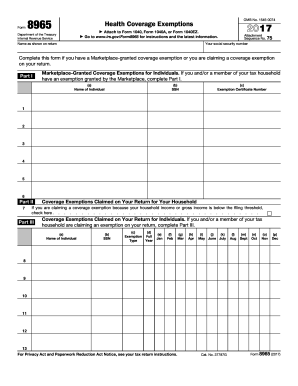

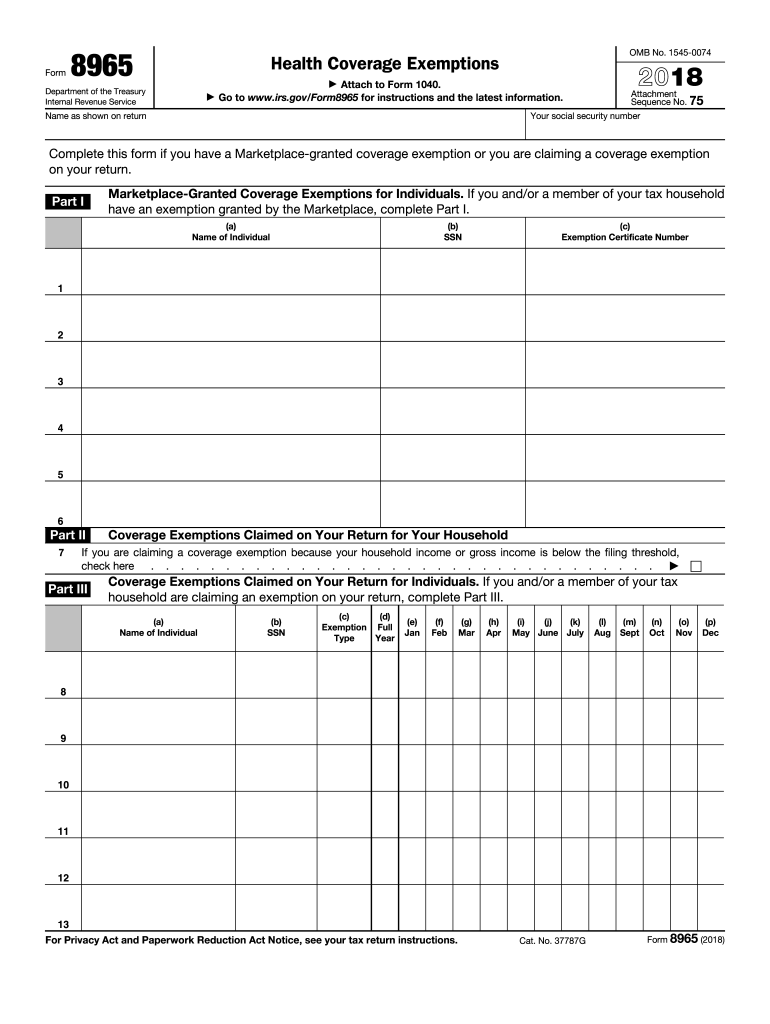

IRS 8965 2018-2026 free printable template

Instructions and Help about IRS 8965

How to edit IRS 8965

How to fill out IRS 8965

Latest updates to IRS 8965

All You Need to Know About IRS 8965

What is IRS 8965?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8965

What should I do if I made a mistake on my IRS 8965?

If you realize you've made a mistake on your IRS 8965 after submission, you can amend the form by filing a corrected version. Ensure you clearly indicate that it is an amended return. Attach a statement explaining the corrections and submit it to the IRS. Keep a copy of both the original and amended forms for your records.

How can I verify the status of my IRS 8965 submission?

To check the status of your IRS 8965 submission, you can use the IRS 'Where's My Refund?' tool or the e-file status tracking feature if you filed electronically. If you encounter issues or receive a rejection code, follow the specified instructions to resolve the issues before re-submitting.

What are common errors to avoid when submitting IRS 8965?

Common errors when filing the IRS 8965 include inaccurate Social Security numbers, incorrect filing status, and failure to report all required information. Double-check all entries against your tax documents to prevent delays or rejections in processing your form.

How long should I keep my records related to IRS 8965?

It is recommended to retain all records related to your IRS 8965 for at least three years from the date you filed the form. This includes any supporting documents and copies of the forms submitted, to ensure you can address any inquiries or audits that may arise.

Can I e-file my IRS 8965 using mobile devices?

Yes, you can e-file your IRS 8965 using compatible mobile apps or browser-based services that support e-filing. Ensure your device meets the necessary technical requirements and that all information is entered correctly to avoid issues during submission.